Understanding a destination’s main currency is essential for travelers, since it ensures seamless transactions and a more enjoyable travel experience.

In this post, I cover Canada’s official currency. I’ll share information on the exchange rate and different denominations, plus a brief history of the currency.

You’ll also have a chance to learn about the quirky designs and security measures of Canadian bills, how to exchange your money without being ripped off, and other payment options that don’t involve cash.

By offering up some financial tips for travel to Canada, I hope you’ll have an easy time managing your money during your visit to the Great White North.

What Currency Does Canada Use

Canada uses the Canadian Dollar and is denoted by a dollar sign.

The currency code for the Canadian dollar is CAD and the currency symbol used is $ (most commonly used in Canada, where it is frequently written as C$ to avoid confusion with other currencies, including USD and AUD).

Exchange Rate and Denominations

Let’s talk about the actual Canadian money.

Denominations | Coins/Banknotes |

|---|---|

Coins | $5, $10, $20, $50, $100 |

Banknotes | 5¢, 10¢, 25¢, $1(loonie), $2(toonie) |

The smaller coins come in really handy for small purchases, such as a coffee, for example, while the bills are more commonly used for larger purchases.

Carrying some smaller bills to use for your day-to-day purchases is always wise. But for anything, where you’re going to be shopping or eating out, paper currency is preferable. And always make sure to familiarize yourself with exchange rates for travel abroad.

If you plan on traveling to Canada, it’s useful to have an understanding of exchange rates. Exchange rates show you how much your domestic currency is worth in Canadian currency.

They fluctuate daily, so it’s wise to check the most current rates prior to your trip.

For a current listing of the exchange rate for the Canadian dollar with other currencies. it’s best to visit: https://wise.com/us/currency-converter/currencies/cad-canadian-dollar

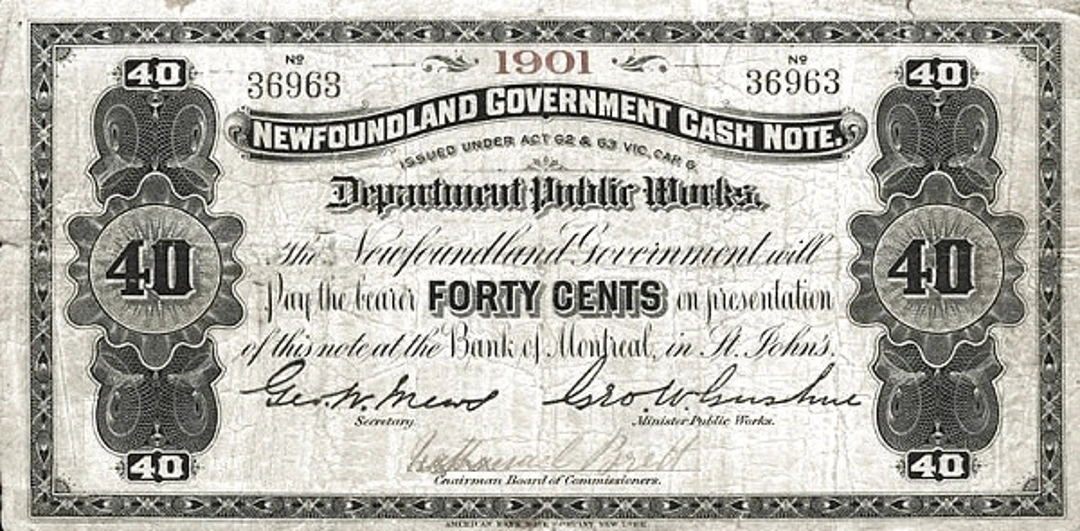

A Brief History of the Canadian Dollar

Early Currency

Before 1800, Canada did not have one official currency. People exchanged a variety of foreign currencies, such as French livres, British pounds, and Spanish dollars.

While this arrangement now seems strange, it was the norm back then. Each area had its own preference, based on who ruled them as a colony.

The whole situation was a bit of a mess but it created a foundation for the diverse and flexible currency Canada would have.

Birth of CAD

The Canadian dollar was established in 1858.It was named after the country as a whole but based on the widely circulated American currency.

Prior to the Canadian dollar, the official currency in circulation within Canada was the Canadian pound, which was the British currency used and circulated locally. This created confusion and was generally impractical in the world of trade.

By adopting the dollar, Canada opened itself up to better trade prospects with the U.S., as well as continuing to build its own economy lest it fall behind its southern neighbor.

Modern Era

During the latter half of the 20th century, Canada made some interesting changes to its currency.

The $1 “loonie” coin was first made in 1987, followed by the $2 “toonie” in 1996. Canadians absolutely love these coins.

In 2011, Canada introduced polymer banknotes for all of its increasingly high-tech bills, which are super durable and hard to duplicate.

These changes have helped make the currency more secure and prevents counterfeiting. It shows that the country is dedicated to keeping the Canadian dollar a modern, reliable currency.

Currency Design and Security Features

In addition to its colorful appearance, Canadian money also printed on polymer, resulting in a more durable note that won’t tear in your wallet or disintegrate from the moisture.

Canada’s currency is easy to figure out, as all the bills are different colors and they all have portraits of famous Canadians in the front.

You’ll find it easy to distinguish each bill, whether it’s the blue $5 bill that has Sir Wilfrid Laurier on it or the red $50 bill with William Lyon Mackenzie King on it.

But Canadian bills are special for their high-tech security features.

They have see-through windows, raised ink, hidden holograms, etc. You’ll see a shiny metallic foil in some, or you can spot numbers that only appear when you hold the bill up to the light.

These unique touches don’t just look neat, they also make Canadian currency some of the toughest to fake.

Where and How to Exchange Money

Before Arrival

Exchanging money at your hometown bank is the most sensible first step before you travel to Canada.

That way, you won’t land in the country without any of the local currency. You’ll have a little cash for a taxi, a bottle of water, or a small snack until you can get to a money exchange location.

Banks will provide you with a good rate and they won’t rip you off with high fees — it’s easy and prevents any stress when you arrive.

Just make sure to have some Canadian cash before you leave home to avoid roughing it when you land.

Banks and Credit Unions

After you arrive in Canada, the best way to get some local currency is by visiting a bank or credit union.

They usually provide the best rates, and it’s safe and guaranteed you’re getting a good rate. Banks are scattered throughout town, so finding one where you can stay won’t be hard.

Just be sure to visit during bank hours, which are usually from 9am-5pm. Plan your visits and bring ID with you.

Currency Exchange Kiosks in Airports

The airport currency exchange kiosks are so convenient. They’re right after you get through security and before you step out of the terminal.

But remember, they usually always have less favorable exchange rates than what you’ll find at a bank.

While you should try not to exchange a lot of your money in one of these kiosks, at least exchange a little for your immediate needs.

ATMs

ATMs are the best way to get Canadian dollars. Nearly every town has one.

They usually charge the best exchange rates and withdrawal fees. If you have a debit card, you can use it in Canada.

Your bank will likely charge a fee, so be sure to contact your bank first, find out any international fees, and inform them of your travels so they don’t freeze your card.

Payment Methods Beyond Cash

Credit and Debit Cards

Canada is a country with a wide usage of credit and debit cards, with the majority of the population having at least one of the two.

Most establishments all across the country accept cards, whether you’re shopping at local boutiques or international retail chains.

Debit cards link directly to your bank account, eliminating the possibility of overspending. However, be mindful of potential fees regarding currency conversion and international transactions.

Advantages

Widely Accepted: You can use them in shops, restaurants, and taxis, so you may not need as much cash.

Convenient Online Transactions: It also takes the effort out of booking hotels and activities.

Tracking Expenses: This will help you budget and also when something is going missing.

Disadvantages

Foreign Transaction Fees: Some banks do charge a fee so check with your bank before you go.

Potential Security Issues: Never disclose your card details or you risk getting scammed.

Contactless Payments

Contactless payments are the new standard in Canada. It’s easy – simply tap your card or phone on the reader, wait a second until the light goes green, and you’re good to go.

If you’re someone who buys a lot of little things (like morning coffees or bus rides), it also eliminates the need to constantly have cash on hand.

Plus, the additional security of these transactions is a good way to keep your information safe from hackers and thieves.

Just be sure to watch your limits, as some cards have caps on contactless purchases and you may need to use another method for larger purchases.

Advantages

Quick and Easy: Ideal for small transactions such as coffee or public transport.

Widely Used: Most places, and that includes mom and pops, accept tap-to-pay.

Secure: Most also include security features to prevent fraud.

Disadvantages

Limit on Transactions: You wouldn’t want to use that for a large purchase.

Not Fully Accepted Everywhere: Though prevalent, contactless payments are not universally accepted in rural places.

Mobile Apps

Mobile payment apps provide an additional level of convenience and seamlessness for conducting financial transactions.

As they allow you to connect your bank accounts, and in some cases, your cards, to your phone, there’s no longer a need to carry a physical wallet Hashtags across the world.

Users should check if the app is supported by their bank and secure their device from unwanted access.

Advantages

Convenient: All your payment methods are here on your phone.

Easy Tracking: A lot of apps offer instantly updated spending trackers.

Integration with Existing Services: Apple Pay, Google Pay and others connect to most banks around the world.

Disadvantages

Dependence on Technology: You’ll need a stable internet connection and a charged device.

Compatibility Issues: Not all banks or payment options may work on your phone.

Tips for Currency While Traveling in Canada

Carry a Mix of Cash and Cards

When visiting Canada, it’s a good idea to carry cash as well as cards. Cash is useful for small items and in locations that don’t take cards.

However, cards are accepted almost everywhere and are easier to use when making big purchases.

Packing a mix of cash and cards allows you to be prepared for everything, such as buying from a vendor to dining out.

Notify Your Bank Before Travel

It’s important to notify your bank that you’ll be visiting Canada. This will stop your card from being frozen when they notice a sudden overseas transaction.

Most banks watch for fraud, and a shift in your location or spending habits can raise red flags. By giving them a heads up, you’ll have uninterrupted access to your money.

Use ATMs in Secure Locations

While there is no shortage of ATMs in Canada, it’s important to choose wisely. Opt for machines in well-lit places, rather than isolated spots.

Overall, ATMs have the best rates, so always use them instead of an exchange kiosk. You’ll also want to do a quick scan for any signs of tampering or suspicious activity.

Keep Small Bills and Coins for Tips, Transit, and Small Purchases

It’s useful to have small bills and change for a number of things in Canada. Keep some loonies, toonies, and a few smaller bills in your wallet.

They offer a lot of flexibility and convenience when traveling on a daily basis.

Consider a Prepaid Travel Card Loaded with CAD

Prepaid travel cards are another option for keeping your money safe in Canada. Just load on the card the amount you want to spend, based on exchange rates, before your trip.

They are accepted everywhere, just like a regular debit or credit card, and offer a measure of security.

FAQ

1. Can I use US Dollars in Canada?

Some places near the US-Canada border may still take US Dollars, though I recommend using Canadian Dollars for a better rate and to avoid any confusion.

2. Why is it called a “loonie”?

The $1 coin was named the “loonie” after its loon bird (a common Canadian bird) design.

3. What should I do if my credit card has foreign transaction fees?

Before you go, ask your bank if they offer a card with no foreign transaction fees or use a prepaid travel card.

3. What should I do if my bank freezes my card during travel?

If your bank puts a hold on your card while you’re in Canada, it’s important that you call them immediately to confirm the charges. Bring a second card or cash and inform your bank of your travel plans.

4. What types of payments are generally used for tips in Canada?

It’s normal to tip in Canada, and opposed to a lot of larger countries, all small bills and coins are widely used.

Conclusion

Understanding what currency is used in Canada and how to manage your money is key to planning a hassle free visit.

Canada’s national currency is the Canadian dollar, meaning you’ll have a variety of payment methods.

Learn how to get the best exchange rate, which payment methods to bring with you, and more so you can make traveling within Canada about exploring what this country has to offer, without hassles surrounding your currency.